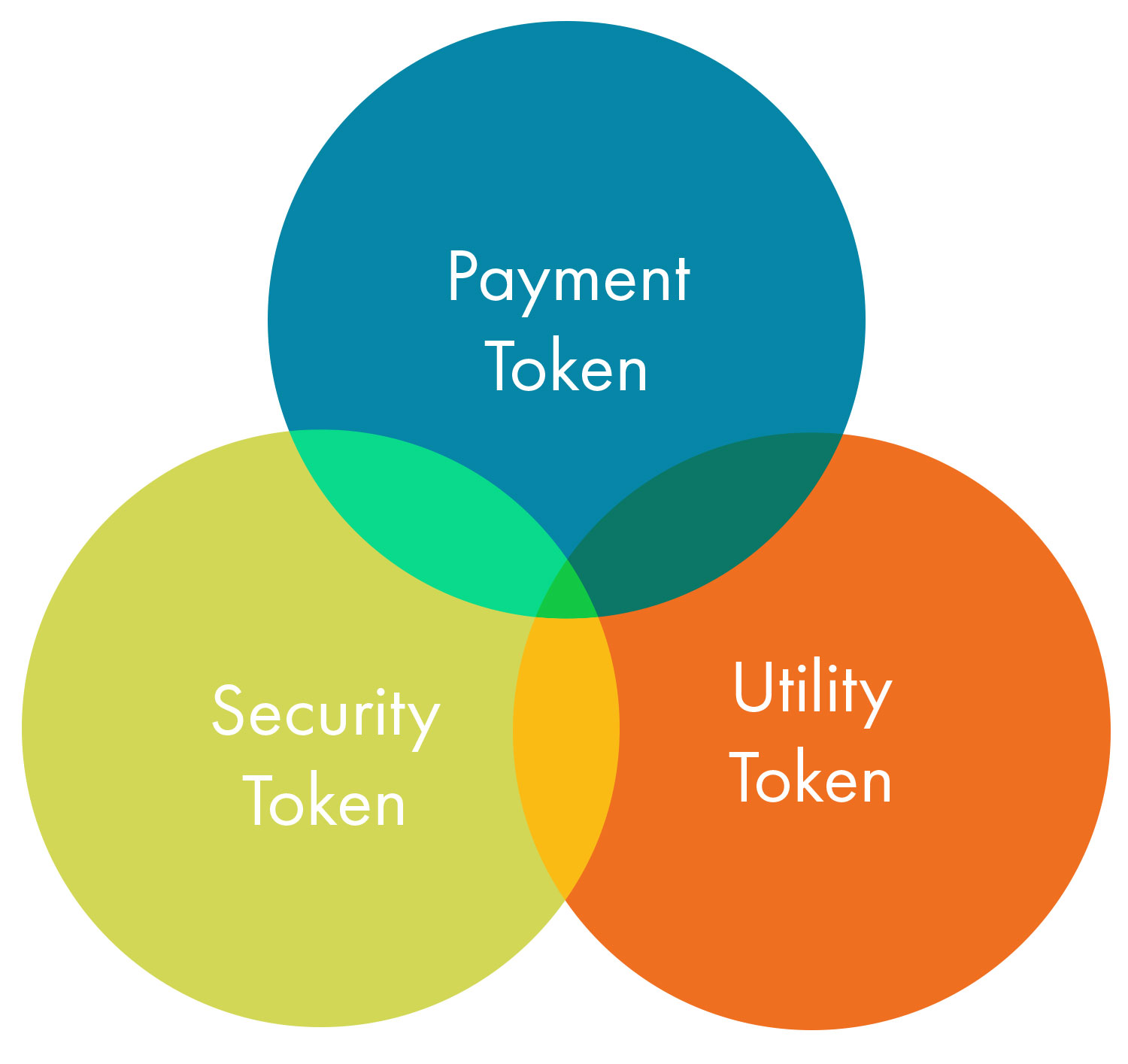

Currently there is no legally recognised classification of tokens, neither in Austria nor on a European or international level. The literature differentiates between three different types:

- Security / Investment Tokens (hereafter referred to as “Security Tokens”)

- Payment / Currency Tokens (hereafter referred to as “Payment Tokens”)

- Utility Tokens

This classification does not allow final conclusions to be made with regard to the assessment under supervisory law, but is far more intended to make it easier to gain an overview about the types of token to be found on the market. This classification is neither conclusive, since there are both hybrid forms as well as further types of tokens (which are not covered here in closer detail), nor do such classifications address future technical developments. The classification under supervisory law must in any case always be conducted on a case-by-case basis, for which reason, prior to the implementation of a proposed business model it is recommended to send an enquiry to the FinTech Point of Contact to clarify any supervisory laws that must be observed.

As is apparent from the figure above, in practice hybrid forms and overlaps frequently occur, for which reason an assessment under supervisory law may only occur on a case-by-case basis.

We would advise that all of the FMA’s interpretations are made subject to further developments, both on a European level as well as due to any changes in the national legal framework, such as in the form of a legal definition.

Security Tokens

Security tokens embody claims for a pay-out (“future cashflow”) towards the issuer, which may be designed in accordance with corporate law or under contract law. Furthermore rights under company law, such as voting rights at a general meeting may also be associated with Security Tokens. Such tokens therefore usually embody claims to the payment of capital, whether in the form of participation in the profits of the company or in the form of interest payments and repayment. In this instance it is not compulsory for such claims to exist in a legal tender currency.

The design of such security tokens is therefore similar to that of “classical securities” in particular bonds or shares. Security tokens are therefore frequently considered as transferable securities as defined in Capital Market Act (KMG; Kapitalmarktgesetz) as well as the Securities Supervision Act 2018 (WAG 2018; Wertpapieraufsichtsgesetz 2018) (Link to external page. Opens in new window.) .

When does a transferable security as defined in the KMG/WAG 2018 exist?

For a transferable security as defined in the Capital Market Act (KMG; Kapitalmarktgesetz) as well as the Securities Supervision Act 2018 (WAG 2018; Wertpapieraufsichtsgesetz 2018) (Link to external page. Opens in new window.) to exist generally the following criteria must simultaneously occur:

- “Embodiment” of the right: The right is dependent on the possession of the transferable security. A classical securitisation in the form of a (global) certificate is not necessary according to the prevailing opinion for the definition of a transferable security under European law (Kalss/Oppitz/Zollner, Kapitalmarktrecht² Article 11 No. 15; Zivny, KMG² Article 1 MN 69).

- Tradability on the Capital Market: The transferable securities are designed identically in large quantities and are substitutable between one another (standardisation). Transferable securities may be transferred and traded without any restriction (transferability). It must be at least generally possible for the transferable securities to be traded on a capital market, although a specific listing or specific inclusion in trading is not necessary (tradability on a capital market in a narrower context).

- Comparability with shares, bonds or similar transferable securities (see the definition in WAG 2018 (in German) (Link to external page. Opens in new window.) ): The European legislator has standardised three types of transferable securities. The list includes shares, bonds and other similarly designed forms. A general comparability of these standardised types is required.

- No exception: In turn, certain instruments are not covered by the term transferable security, e.g. certain payment instruments, bills of exchange, savings account books or money-market instruments.

Security tokens are usually qualified as being transferable securities as defined in the KMG/WAG 2018, since the aforementioned criteria are fulfilled:

- “Embodiment”: The proprietary right usually depends on “possession” of the token. Usually, in the event of a transfer the various functions (legitimation function, evidential function, presentation function, and transport function) are transferred to the new holders. The documentation through the Blockchain/Distributed Ledger Technology may be considered to be sufficient (Dobrowolski, GesRZ 2018, 147 (156); Zickgraf, AG 293 (302); Hacker/Thomale, Crypto-Securities Regulation (Link to external page. Opens in new window.) [retrieved on 18.9.2018]).

- Tradability on the Capital Market: Tokens are usually standardised and are transferable without any restrictions. A “listing” or an “inclusion” in a trading platform for crypto assets is therefore generally possible without any further action.

- An “exception from the term securities” does not usually exist, as there is usually no payment function, but instead claims against the issuer are paramount.

- “Comparability with classes of transferable securities that may be traded on the capital market”: This criterion therefore depends on the legal claims against the issuer and is also generally satisfied regarding claims to “future cashflows”.

The following examples should demonstrate the allocation of Security Tokens as transferable securities:

- A Token authorises the holder to participate in the profits of the issuer: five per cent of the profit stated on the balance sheet is distributed to all token holders (split pro rata by units held) (“similar to shares”).

- A token authorises the holder to receive three per cent interest per year, with a repayment of the capital intended to take place after ten years (“similar to bonds”).

When is a Security Token considered an Investment as defined in the Capital Market Act (KMG; Kapitalmarktgesetz)?

If the security token is not a transferable security as defined in WAG 2018/KMG, then it may also be an investment as defined in the KMG, in particular in the case that a token/coin is not transferable or its transfer is restricted, but claims to capital or returns are embodied and a risk-sharing group exists. In the case of a public offering, then in this instance an investment prospectus would be necessary.

Rules for Security Tokens under Financial Market Supervision Law

If a token is classified as a transferable security, there are – depending on the precise business model – a wide range of rules that apply under financial market supervisory law. The most important obligations should be summarised here to create an overview:

For providers/issuers:

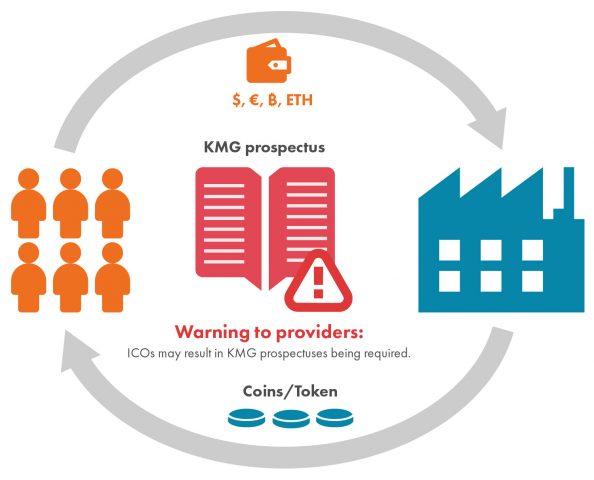

- The public offering of transferable securities requires the publication of a securities prospectus that has been approved by the authorities and is subject of the Capital Market Act (KMG; Kapitalmarktgesetz), provided that no exemption exists from the obligation to publish a prospectus.

For trading venues which “list” or include such tokens

- Depending on the type of trading conducted it is usually to be assumed that the operator of the trading venue is subject to the obligation to hold a licence, as a stock exchange or as a multilateral trading facilities (MTFs)/organised trading facilities (OTF). The Stock Exchange Act 2018 (BörseG 2018; Börsegesetz 2018) as well as the Securities Supervision Act 2018 (WAG 2018; Wertpapieraufsichtsgesetz 2018). In the case of listing or inclusion on a trading venue, for example a regulated market or an MTF/OTF the rules for preventing insider information as well as market manipulation as well as very transparency requirements apply. For the sake of completeness, we would advise that against the background of the infrastructure requirements and frameworks (e.g. in conjunction with Regulation (EU) 909/2014) such a listing or an inclusion for trading on the aforementioned platforms is subject to legal and practical impediments (see below for further information). The latter issue should also be taken into account when planning such a trading platform on which the aforementioned instruments are intended to be traded.

For the provision of investment services

- Irrespective from the operation of an MTF/OTF that has already been addressed, the provision of investment advice on a commercial basis, the receiving and transmitting of orders and well as portfolio management in relation to tokens that are classified as transferable securities, also requires a licence under WAG 2018.

For the commercial custody of tokens for third parties

- When safekeeping and administration occurs as per the definition contained in the Securities Depot Act (DepotG; Depotgesetz), then an obligation to hold a licence in accordance with the Austrian Banking Act (BWG; Bankwesengesetz) exists, since it is considered to be a banking transaction.

- In addition the following rules may also apply.

- A wide range of standards need to be observed in conjunction with securities transactions – such as, depending on the precise procedure or business model: Securities Depot Act (DepotG; Depotgesetz) in German only (Link to external page. Opens in new window.) , EMIR, SFTR, Benchmarks Regulation, Prohibition of Short Selling, CSDR (Link to external page. Opens in new window.) , the Nationalbank Act (NationalbankG; Nationalbankgesetz 1984) (Link to external page. Opens in new window.) or the Settlement Finality Act (FinalitätsG; Finalitätsgesetz) – in German only (Link to external page. Opens in new window.) .

Other (licensing) requirements may also exist.

- Depending on the design furthermore the Austrian Banking Act (BWG; Bankwesengesetz), the Alternative Investment Fund Managers Act (AIFMG; Alternative Investmentfonds Manager-Gesetz) or other laws, such as the Payment Services Act 2018 (ZaDiG 2018; Zahlungsdienstegesetz 2018) or the E-Money Act 2010 (E-Geldgesetz 2010) as well as provisions in relation to the prevention of money laundering may also apply. In the case of listing or inclusion on a trading venue, for example a regulated market or an MTF/OTF the rules for preventing insider information as well as market manipulation apply.

Payment Token

A payment token is a type of token, the primary purpose of which is a payment function. Payment tokens therefore represent a specific value, with which goods or services may also be acquired from persons other than the issuer. Payment tokens generally are not intended for any other usage.

With regard to the treatment of payment tokens under financial supervisory law the specific circumstances for the case in hand are of essential significance. Depending on the specific design of the ICO or the coin/token various circumstances may exist that require a licence. The most important activities requiring a licence should be summarised here to create an overview.

By issuing a payment token the activities requiring a licence of issuance and administration of payment instruments pursuant in accordance with Article 1 para. 1 no. 6 BWG and the issuance of e-money as defined in the E-Money Act 2010 (E-Geldgesetz 2010) may be met. In this case it depends whether the token may be used for payment with third party acceptors, and whether it may be purchased or exchanged (or paid out) against money. In the case of the issuance of payment instruments in accordance with Article 1 para. 2 no. 5 ZaDiG 2018 on the other hand it depends on the personalisation (see above).

The common factor with all three activities is that there is not licencing requirement in the case that a “limited network” exists (for detailed information about the “limited network” concept as well as examples, see FMA Focus on Alternative Currencies):

Small and specific systems are not intend to fall under the strict supervisory laws. However, once the system enables a broad range of applications, then it should be regulated. Open networks therefore generally do not tend to be exempted from the obligation to hold a licence, since there are conceived as a general rule for a constantly growing network of service providers. Coins/tokens, that are intended to be widely accepted, therefore do not fall within the definition of a limited network.

Whether a limited network exists, is determined on the basis of the following criteria:

- the geographical range of the system

- the number of accepting entities

- the variety of types of products and services

- restrictions on validity and restrictions on contributions involved may also play a role.

Criteria for the obligation to hold a licence for payment tokens

Generally the following questions serve as criteria for the FMA for making a judgement in accordance with supervisory law, whether or not an obligation to hold a licence may exist:

- Who is the issuer of / generates the payment token?

- Is the payment token used for paying for goods or services at third parties?

- How large the network within which the payment token fulfils a payment function?

- Are pay-outs made in legal tender currency?

Payment tokens that are not only intended to be used within a limited network, may therefore depending on their design trigger an obligation to hold a licence in accordance with the BWG, ZaDiG 2018 or E-GeldG 2010.

Utility Tokens

Utility tokens primarily service to provide the holder with a benefit with regard to a specific product or a service. Frequently they permit access to a digital platform operated by the issuer, which may be used in a specific fashion by the holder of the utility token. Utility tokens occur in many different forms and often also fulfil the function of payment tokens or security tokens (hybrid design) thereby making the definition complex and its allocation under supervisory law difficult. The right may be secured with a utility token in particular to jointly design a product or a service, to use a product or a service or to redeem the token in return for a product or a service. Frequently utility tokens are sometimes associated with an intrinsic payment function towards the issuer or other users of the platform operated by the issuer.

Examples:

- Example of jointly designing of a product: A social media platform intends to provide different functions. Holders of the token may help to determine which functions the network should offer.

- Example for using a product or a service: A token grants access to a database, as long as it is held for.

- Example for discharging a token for a product or a service: A web designer issues a token for website design purposes. The token may be redeemed with the web designer issuing the token to have a website designed.

If the token can only be used for designing a product or a service and is not associated with any other claims or if the token only grants access to a product or a service, without simultaneously serving a purpose for payment, then there is usually not any linkage under supervisory law. However a requirement to hold a licence may still exist on a case-by-case basis.

If on the other hand the token may be redeemed with the issuer or other users of the platform for using a product or a service, then it fulfils a payment function and is therefore comparable to a payment token. For its classification in accordance with supervisory law, then the same criteria and exceptions are relevant in this case as for payment tokens. The exception that exists for a “limited network” often applies (see the explanations about payment tokens).

Furthermore, utility tokens may also have an investment component, in particular where claims exist to the payment of capital, interest or similar, or where the investment function is the primary focus. In this case a transferable security or an investment may exist (see the explanations about security tokens). When a utility token may be considered as a transferable security from this point of view on a case-by-case basis is currently the subject of European and internal supervisory law discussions and cannot be generally answered.

Due to the wide range of different options in relation to design as well as the frequent existence of hybrid forms, it is particularly necessary in the case of utility tokens to check on a case-by-case basis, whether there is a linkage to financial or capital market law.

Source: FMA Austria, https://www.fma.gv.at/en/cross-sectoral-topics/fintech-navigator/initial-coin-offerings/